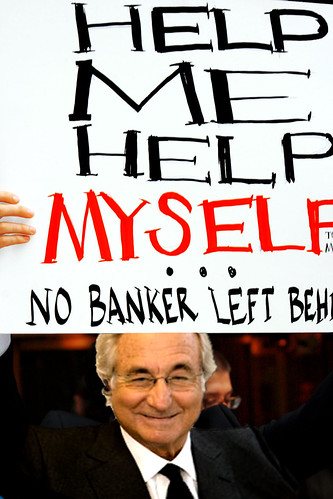

photo: "Help Me Help Myself," Alane Golden c. 2008.

photo: "banksy rat 03," Matthew Strong c. 2006.

New evidence suggests Bernie had powerful accomplices in his scheme—philanthropist Norman Levy and a second accountant. Lucinda Franks reports on the international investigation.

It has always been hard to believe that Bernie Madoff acted alone to carry off his labyrinthine conspiracy. Now new evidence about two key associates—the late Norman Levy, a real-estate mogul and philanthropist who has previously been portrayed as a victim, and Paul Konigsberg, a second accountant for Madoff—begins to reveal that he may have had a powerful network of accomplices whom investigators on a U.S.-U.K. task force believe were involved in an international transfer of money.

"All these people, we think they were in it together," a source with knowledge of the investigation explains. "That is what we are trying to gather evidence to prove.”

"Konigsberg and Levy were very close to the center of Madoff action," the source continued. Levy was a towering figure in New York real estate—at one point he owned the Seagram Building—and he and Bernie Madoff had a special bond. Ruth and Bernie Madoff had an intimate relationship with Levy and his wife, Betty. Madoff and Levy contributed to many of the same causes and philanthropic organizations, including New York’s Yeshiva University and several smaller, more arcane charities such as Gift of Life, a South Florida charity for Jewish leukemia victims.

Madoff was long known to have been Levy's "fixer," obtaining everything from choice restaurant reservations to emergency medical care. Levy had offices one floor below Madoff's in New York’s Lipstick Building. It was Levy who introduced high-profile investors to Madoff.

One of those investors was Levy’s longtime girlfriend—following the death of his wife—model Carmen Dell’Orefice. In an April 2009 Vanity Fair article, which portrays Levy as a father figure betrayed by Bernie’s scheme, Dell’Orefice spoke of vacationing with the Madoffs, socializing in New York, Palm Beach, and the south of France, and celebrating birthdays and holidays together. But, Dell’Orefice told the magazine, “Norman and Bernie never talked business, except on the telephone.”

When Norman man Levy died in 2005 at the age of 93, Madoff extolled him as a man whose friendship he had cherished and who had "taught me so much." Around the time Madoff’s business crashed, Levy's son Francis told Fox Business News that his father believed in Madoff: "If there's one honorable person,” he said, “it's Bernie." Shortly afterward, Levy's daughter, Jeanne Levy-Church, had to close the doors of her beloved foundation, JEHT, which helped the less fortunate, especially ex-convicts, because all her funds had been invested in this honorable man's business.

The extent and nature of Levy’s involvement is not yet fully known. Levy is believed to have helped accountant Paul Konigsberg funnel checks to London. And investigators in New York say there were apparently billions of dollars worth of checks going back and forth between Madoff and Levy (or someone using Levy’s name). Levy's family members could not be reached for comment.

Sources in London also reveal that a general ledger of Madoff accounts listed Konigsberg, of the reputable accounting firm of Konigsberg, Wolf & Co., as receiving $30,000 a month to advise the MSIL operations, and funnel client checks to the London office for Madoff's own use.

Konigsberg also had a close working relationship with Madoff that went back 25 years. He even went on a ski trip to Zermatt, Switzerland, that Madoff had arranged. In addition to his duties in the London office, Konigsberg prepared the tax returns of two Madoff charitable foundations as well as the foundations of at least six of Madoff's close friends, including those of Norman Levy's, and Carl and Ruth Shapiro's (whose son-in-law Robert Jaffe is now under scrutiny by investigators as a business partner of Madoff). These foundations, as well as Konigsberg himself, said they were heavily invested in Madoff Securities and lost millions of dollars.

Moreover, in the 1980s the accountant was given a small share (less than .4 percent) of MSIL, which was otherwise owned by only Madoff family members. When Konigsberg showed up at the London office, a worker said staff members were very obedient to his instructions. Other times, he apparently directed certain operations in London from his chair in the New York firm. "It doesn't take a lot of footwork to wire money and transfer client funds from one office to another," said the London source.

Levy is believed to have helped accountant Paul Konigsberg funnel checks to London. And investigators in New York say there were apparently billions of dollars worth of checks going back and forth to between Madoff and Levy (or someone using Levy’s name).

Konigsberg's lawyer, Charles Stillman, said his client vigorously denies these accusations: "The London office was a virus. Paul had nothing to do with this operation or any other Madoff office."

Although Konigsberg says he did not solicit Madoff customers, his firm has been issued, and is cooperating with, a civil subpoena by the SEC investigating the Madoff affair. Moreover, one of his firm's principals, Steven B. Mendelow, solicited funds for Madoff, violating federal regulations, which he settled with the SEC in 1993.

The investigation of Konigsberg represents the second accounting firm implicated in the Madoff subterfuge. David G. Friehling, who headed a storefront office which simply rubber-stamped the Madoff finances, has been indicted and is now cooperating with federal prosecutors. Friehling, however, received only $14,500 a month for his services, less than half what Konigsberg received.

Madoff’s London office was largely dedicated to a fund for the benefit of Bernie and his family, and, according to sources, was also a laundering machine for money that was subsequently sent to banks in other countries. Other client funds were sent from New York to the London office and back again into Madoff's personal proprietary account in New York. It appears that some of the money also went to his inner circle of friends, possibly prominent figures who benefitted from the laundering. Sources in the U.S.-U.K. money laundering task force, had earlier told The Daily Beast that Madoff, as well as some of his closest friends, had put $75 million of London transfers in their wives' names. There has also been certain circumstantial evidence, which U.S. investigators are using to explore possible cases, that Madoff made deals with other philanthropists and titans in various industries; it is thought that he may have given them huge returns on small investments while they, in turn, gave vocal support and lured investors into Bernard Madoff Securities Ltd.

Madoff’s London office was largely dedicated to a fund for the benefit of Bernie and his family, and, according to sources, was also a laundering machine for money that was subsequently sent to banks in other countries. Other client funds were sent from New York to the London office and back again into Madoff's personal proprietary account in New York. It appears that some of the money also went to his inner circle of friends, possibly prominent figures who benefitted from the laundering. Sources in the U.S.-U.K. money laundering task force, had earlier told The Daily Beast that Madoff, as well as some of his closest friends, had put $75 million of London transfers in their wives' names. There has also been certain circumstantial evidence, which U.S. investigators are using to explore possible cases, that Madoff made deals with other philanthropists and titans in various industries; it is thought that he may have given them huge returns on small investments while they, in turn, gave vocal support and lured investors into Bernard Madoff Securities Ltd.

London sources said that a small part of the U.K. trading operations were legitimate, but that they were basically a front for the money laundering. "In one year alone, a billion dollars of transactions were filtered through the London office of Madoff Securities International Ltd," said the London source. "What we are trying to find out is for exactly whose benefit, besides Madoff's, this money was being washed."

Lucinda Franks is a Pulitzer Prize-winning journalist and author who was on the staff of the New York Times and has written for the New Yorker and the New York Times Book Review and Magazine. Her latest book is My Father's Secret War, about her father, who was a spy for the OSS during World War II.

Lucinda Franks is a Pulitzer Prize-winning journalist and author who was on the staff of the New York Times and has written for the New Yorker and the New York Times Book Review and Magazine. Her latest book is My Father's Secret War, about her father, who was a spy for the OSS during World War II.

Live your values. Love your country.

And, remember: TOGETHER, We can make a DIFFERENCE!

No comments:

Post a Comment