Photograph: "In Wankers We Trust", A. Golden, eyewash design - c. 2008.

Photograph: "In Wankers We Trust", A. Golden, eyewash design - c. 2008.

(AP) The governors of

Connecticut Gov. M. Jodi Rell said Wednesday that she, New York Gov. David Paterson and New Jersey Gov. John Corzine have sent a letter to U.S. Labor Secretary Elaine Chao urging her to approve the grant.

The governors say preliminary estimates show that 82,000 financial services jobs in the

The emergency grant would allow the states to give each laid-off worker $12,500 to help them find jobs and relocate and to provide them with other services.

A message left at the U.S. Labor Department was not immediately returned Wednesday. Over the past five months, the unemployment rate for the tri-state region has increased from 4.5% to 5.8%, the governors' letter says. They expect another 160,000 private sector jobs to be lost by the end of this year, and they are bracing for "a deep, prolonged recession."

"Given the bearish economic forecasts for the next two to three years, we anticipate the unemployment rate will continue to rise significantly," the governors wrote.

The majority of workers in the financial industry are in administrative and computer support occupations, according to the letter.

"It is imperative that we sustain the skilled work force most impacted by the financial crisis to help our economy recover," the governors wrote. "The federal government acted swiftly to implement strategies to stabilize financial institutions; now it is time to act together to support the workers dislocated from those institutions.""

Photograph: "Have a Heart.", A. Golden, eyewash design - c. 2008.

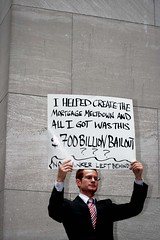

Q: Just how much MORE charity does Wall Street deserve?

A: NONE! Zero! Zip! They didn't deserve a bailout with absolutely ZERO regulation & they don't deserve this second $48 million bailout.

Wall Street has now gotten away with the greatest swindle of the American public in history -- all sugar for the villains, lasting pain and damage for the victims. This swindle cash - OURS - is going - amongst other things - to financial employee bonuses and is also helping those corporations bailed out to acquire - what else - but other failing corporations, enabling these blood-suckers to grow ever more bloated.

Photograph: "Buddy, Can you spare three TRILLION?", A. Golden, eyewash design - c. 2008.

In case you weren't aware, bonuses are being handed out this year! Yes! You might recall last year's Wall Street bonuses totaled $33.2 billion, making it a historic all-time high record! If someone were to tell me these cats didn't know the sh*t was getting ready to hit the fan, then this record proves otherwise. The size of the bonus figures are supposed to reflect employee value to the company. Check out the handy-dandy Historic Wall Street CEO compensation chart from Forbes. I'm inclined to agree with Attorney General Andrew Cuomo when he said this week, "Given this economic situation, how do you justify any performance bonus at all, is my initial point."

In case you weren't aware, bonuses are being handed out this year! Yes! You might recall last year's Wall Street bonuses totaled $33.2 billion, making it a historic all-time high record! If someone were to tell me these cats didn't know the sh*t was getting ready to hit the fan, then this record proves otherwise. The size of the bonus figures are supposed to reflect employee value to the company. Check out the handy-dandy Historic Wall Street CEO compensation chart from Forbes. I'm inclined to agree with Attorney General Andrew Cuomo when he said this week, "Given this economic situation, how do you justify any performance bonus at all, is my initial point." What's NOT to like if you're a financial titan threatened with extinction? Today, the average CEO in the S&P 500 makes about $14 million per year, about 90% of it in the form of performance-based pay. Just what are these Streeters doing? Seriously, I'd really like to know so I too may garner such astronomically inflated financial worth in exchange for complete and utter ineptitude. Wouldn't you?! Personally speaking, Wall Street bonuses have never been justifiable. But now? I'm most obviously missing something. Oh yeah, the ability to suspend all manner of logic and reason. No worries, I'm certain I'll be able to locate it somewhere. In the meantime, it's business as usual in

Believe it or not, I could almost live for an entire year in NYC off $12,500! If you're having a hard time believing this, just go ahead and ask most any artist! WE really know how to make a penny s-t-r-e-t-c-h into a year! It seems Wall Street CEO's and their HR departments have gotten in wrong: they should've been hiring Artists all along, instead of employing boobs who spend their yearly bonuses on Art! Just think what Our lives would've been like if Wall Street had actually hired people who know the value of a buck! In the meantime, they're literally laughing all the way to...well, you know.

Let's take a brief look at those laughing hardest:

Richard Fuld, chief executive of Lehman Brothers, received about $34.4 million last year in a 5-Year Compensation Total of: $354.03 million. He may be disgraced, but something tells me he'll be able to sooth his big, fat ego with the $354 million he has in the bank. Too bad he didn't use good old William Fuld's Ouija board!

Lloyd Blankfein: Goldman Sachs's chief, received a package worth $68.5 million last year. This year, his company took $10 billion from the federal government's capital purchase plan. Oh the shameful fall so greatly cushioned by a cool $68 1/2 million! Compensation at Goldman Sachs Group Inc., Morgan Stanley, Citigroup Inc. and the six other banks that received the first $125 billion of the federal funds is under scrutiny by lawmakers, including Rep. Henry Waxman, a California Democrat, and New York Attorney General Andrew Cuomo also a Democrat. President-elect Barack Obama cited the program at his first news conference on Nov. 7th, saying it will be reviewed to make sure it's "not unduly rewarding the management of financial firms receiving government assistance."

Robert Nardelli: Former executive at General Electric, former CEO of Home Depot & present Chairman and Chief Executive of Chrysler. Nardelli was paid $210-million, was given an additional $20 million severance payment and retirement benefits of $32 million, before being ousted by Home Depot board members in January, 2007 and quickly became the poster child for excessive CEO compensation. Yesterday, Nardelli was among the chief executives of

Alan Mulally: Current Ford CEO and former Boeing exec who, in 2007, was paid $28 million for four months on the job. He got an $18.5 million bonus, almost $9 million in stock and options and base salary at annual $2 million rate. The pay package for Mulally comes on top of the $7.4 million that aerospace company Boeing had previously reported paying him for his eight months running that company's commercial aircraft unit before he made the move to Ford at the beginning of September, 2007. His base salary was $666,667, which works out to annual pay of about $2 million. He also received restricted stock grants, which the company valued at $920,404, as well as 3 million stock options valued at $7.8 million. The stock options are not yet exercisable, and they have an exercise price of $8.28, or about 4% above 2007 prices.

Rick Wagoner: CEO of GM who, in 2008 earned a 33% increased salary from the following year to $2.2 million, restoring his base pay to the level it was before he took a 2006 pay cut As part of the company's turnaround plan, Wagoner's salary was brought back to the level it was from 2003 - 2005. Prior to this pay cut, his salary was $1.28 million. Wagoner's new deal made him eligible for up to $3.5 million in incentive payments and a grant of 165,563 shares of GM stock if he met the company's internal targets. He will also receive 500,000 stock options that will vest over three years and 75,000 restricted stock options that will vest in three - five years.

Photograph: "Swine?", A. Golden, eyewash design - c. 2008.

So, why are these governors suddenly so willing to jump to the aid of the people, but ONLY the people already earning exorbitant salaries? Even by NYC standards, Wall Street salaries are insanely disproportionate. The average salary for Wall Street is: $289,664, while the average salary for ALL of

No, the latter is not a typo. Now, excuse me, but why should the very same people who helped to contribute to the WORLD'S WORST INTERNATIONAL FINANCIAL DISASTER in HISTORY be further rewarded with an infused $12,500? This is an OUTRAGE! Most will be receiving severance pay, a one last shot-in-the-arm hefty bonus (the average bonus per person: $125,000), in addition to a handy weekly $410 in unemployment insurance benefits. Suck it up people!

Now, I hold a double-degree for which I paid myself only having taken out one $1,000 loan in four years. This includes study in:

While I earned a coveted qualified Australian business visa and was an executive in

What's my crime? Did I recklessly and irresponsibly cause a global financial crises? No. Do I live wildly and decadently? Decide for yourself: I reside in an old 1800's converted warehouse I can barely afford to keep warm with two other housemates and ALL my furniture is second-hand. I don't use plastic bags & recycle EVERYTHING. Do I ride on a high horse with an air of disdain befitting that of a royal monarch? No. In fact, my chariot's the humble NYC subway.

So, what exactly did I do to deserve this sub-par treatment purported by my governor? Apparently, my only crimes seem to be that I am a resourceful, intelligent, well educated / traveled, dedicated, hard-working creative individual who cares about the environment and future generations. The exact opposite traits of those in the financial industry sector. The exact characteristics that should be encouraged in society.

Thus, I ask governor Paterson: Where is my - and the 66,000+ already unemployed New Yorkers - $12,500 blank check? I really want to go back to earn a master's degree and haven't figured out how to make this happen, financially speaking. This extra money could be used for this purpose and perhaps give me a little hope for a slightly better tomorrow. So, please explain how further rewarding bad behavior whilst simultaneously punishing the rest of NY's unemployed is in any way justifiable? This is sickening and beyond greatly disturbing. While attempting to balance our budget, you slash-and-burn much needed state programs, are proposing to increase state tuition, and want to make it more difficult for people to get student loans, you've somehow managed to find time to request a $48 million emergency grant to help thousands of financial industry workers who are losing their jobs on Wall Street. Please, help me understand?

RESOURCES:

"Competition for Main Street, Socialism for Wall Street.", by: William Greider, reclaimdemocracy.org. Published 09.23.08

"Wall Street bonuses shrink, but are they justified?", by: Ben White, International Herald Tribune. Published: 11.6.08.

"The Big Banks - Goldman Sachs Braces For Impact": Lloyd Blankfein's firm dodged the blows suffered by rivals. Not anymore., by: Liz Moyer, Forbes - 11.11.08, 12:30 AM EST.

"Ten Most Wanted: Culprits of the Collapse", by:

"CEO Compensation", Edited by: Scott DeCarlo, Forbes

Posted: 04.30.08, 6:00 PM EST

"America's Top-Paid Young CEOs" by: Matt Kirdahy, Forbes. Posted: 08.13.08, 6:30 PM EST

Live your values. Love your country.

And, remember: TOGETHER, We can make a DIFFERENCE!

No comments:

Post a Comment