The Imminent U.S. Financial Apocalypse

Original Post: Republic of Lakotah, January 13, 2009

by: admin

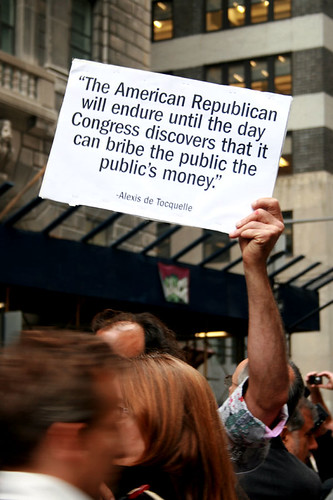

Photographs: A. Golden, eyewash design, c. 2008.

Apocalypse (Greek: Ἀποκάλυψις Apokálypsis; “lifting of the veil”) is a term applied to the disclosure to certain privileged persons of something hidden from the majority of humankind. Today the term is often used to refer to the end of the world, which may be a shortening of the phrase apokalupsis eschaton which literally means “revelation at the end of the æon, or age”.

American Indian, Sustainable Banking System:

American Indian, Sustainable Banking System:

“Once I was in Victoria, and I saw a very large house. They told me it was a bank and that the white men place their money there to be taken care of, and that by and by they got it back with interest. We are Indians and we have no such bank; but when we have plenty of money or blankets, we give them away to other chiefs and people, and by and by they return them with interest, and our hearts feel good. Our way of giving is our bank.” - Chief Maquinna, Nootka

Unsustainable U.S. Banking System:

Approaching $11 trillion dollars [1], the National Debt is a burden of over $35,000 for every man, woman, and child in this country. This debt includes both public debt, much of it repayable to to bond holders, and money borrowed against government trust funds such as Social Security. Put another way, a typical family of four with a medium income of $50,000 [2] already has a debt burden of over $140,000 courtesy of the United States government.

The Dire Consequences:

China holds over 40% of this debt, while Saudi Arabia has about 20%. Many of these bonds have matured! So, if either, or both, of these countries “call in” our bonds, the U.S. will INSTANTANEOUSLY become bankrupt.

As the U.S. financial house of cards implodes, the following calamities are virtually inevitable:

- Massive inflation - The once mighty dollar will no longer be used as a global currency (ushered in will be the Amero)

- Massive Unemployment (well underway)

- Massive Wage Deflation - With mass inflation, wages for those even still working will not keep up with prices on a daily and weekly basis. (Americans have earned the same wages for 40 years*)

- Massive Shortages - Food riots become possible. There is no incentive to sell goods today that can be sold at a higher price tomorrow. (Farmers are being bankrupted as you read)

- Massive Civil Unrest - It seems the government has already prepared for this by eliminating the Posse Commitatus Act. (well underway - come visit NYC for proof)

We know these things can and will happen in part because in the 1920’s Germany experienced a very similar debt crisis. This was caused by the massive war reparations imposed by the other western nations after the first World War. Even without calling in these debt bonds, the threat to do so offers considerable leverage to bond holders. When the British Empire, similarly indentured to the United States tried to seize the Suez canal in 1956, the U.S. threatened to call in those bonds and similarly collapse the U.K. Through a single threat of debt collection, the United States was able to immediately replace Britain as the hegemonic power in the Middle East.

In addition to debt financing, this government extracts money from the general population through coercive taxes. Money that is collected by the government is certainly not returned to taxpayers with interest like a bank. Nor is much of it used to help people in need, as a kind of giving bank. Much of the money that is collected is used either to pay off existing debts or to finance the military, whether during an active war, or in preparation for new wars. Most recently tax payer money is also used to re-finance the debts of wealthy investors and banks who had assumed risks and now wish to avoid the consequences of their bad investments; or to prop up select and well connected private corporations, in a kind of perverse socialism for the rich.

While this money is being used for increasingly anti-social purposes, the consequence of this debt is also indenturing this nation and the national government to bond holders much like how the IMF has used world bank lending to indenture and economically re-colonize other nations, as no true political sovereignty can exist when in economic servitude. Bond holders have also used debt to force former colonial nations to adopt socially destructive policies against their own people to maximize the extraction of private profit, much like the United States government now does against the people of this nation.

With respect to bonds underwritten by the United States government, this debt cannot be terminated, for to do so would eliminate the ability to burrow to buy more weapons of war or to reward the rich. Instead, this debt is secured with future taxes, or the future income and hence what in effect has become the indentured labor of the population of the United States. While the 13th amendment ended one form of slavery, debt slavery, unfortunately, is still very much alive and well in the United States today.

This burden however is not even equally shared in the United States. As recently noted by the Government Accountability Office, over two thirds of private corporations have paid no taxes in perhaps the last decade [3]. Even more dramatically, late last year close to a trillion dollars was authorized to be given to banks and other private institutions, while another 7 trillion had already been made available in interest free loans to these same institutions through the federal reserve. This is a true redistributionist policy, but rather than to each according to their needs, at least an admirable intention, instead openly sacrifices the very real needs of the many for the greed of a very few.

Of course, the elderly are not able to contribute taxes. But they do have trust funds secured by social security taxes from past labor. This money will also be spent, whether immediately to finance further deficit spending, or ultimately, to help secure, along with those future taxes, bond holders debt.

These funds will of course continue to disappear, like so many private pension funds that have been raided, by the very hands of those that are trusted to “manage” them, for the elderly certainly offer no profit or future potential return for these bond holders.

There are two other choices remaining. First, there is asset sale. One problem is that most “assets” claimed by the present United States government are lands either claimed to be held “temporarily” in trust for existing indigenous nations, or illegally appropriated from said nations. The second choice is to simply print more money. This, too, will upset the bond holders, as it means the value of their existing bonds dilute.

If we think of the United States as really a kind of corporation, then clearly bond holders are the real share holders, who’s life, liberty, and pursuit of happiness the government is here to secure and protect, while those called citizens are merely indentured employees dispossessed of their property and income while living in a new, larger reservation, that is called the United States.

[1] U.S. NATIONAL DEBT CLOCK

The Outstanding Public Debt as of 14 Jan 2009 at 12:48:42 PM GMT is:

The estimated population of the United States is 305,458,811

so each citizen's share of this debt is $34,751.92.

The National Debt has continued to increase an average of

$3.39 billion per day since September 28, 2007!

Concerned? Then tell Congress and the White House!

[2] http://www.census.gov/Press-Release/www/releases/archives/income_wealth/012528.html

[3] http://www.gao.gov/new.items/d08957.pdf

Live your values. Love your country.

And, remember: TOGETHER, We can make a DIFFERENCE!

No comments:

Post a Comment